At a glance, the public relations (PR) industry is a mature industry, with billions of profits worldwide, and a steady growth over the year. In Vietnam, there are hundreds of new PR establishments opened every year, with the average sales growth of $50 million per year in the recent years. However, is this really a lucrative industry?

Market scope and growth

The PR industry is the industry that comprises establishments primarily engaged in designing and implementing PR campaigns to promote the interests and image of their clients. The services call for communication and maintain a relationship with the government, investors, analysts, employees, customers, consumers and the general public. According to The Holmes Report, in 2019, the global PR industry was worth $15.5 billion, up from $15.0 billion in 2018. The top 250 PR firms generated fee income of $12.3 billion in 2018, up from $11.7 billion in the previous year. Midsized firms achieved the strongest growth and innovation, offering all the integrated services in digital and social and influencer and content creation.

The global PR industry is in the mature stage of its life cycle. The maturity is characterized by a slow but steady growth of the industry, the services are known and accepted, and service demands are high and consistent.

A positive note is that the industry tends to extend its maturity instead of stagnating it. The rise of technology and digital platforms could be seen as a disruption to the life cycle. The widespread digitalization challenges PR firms to keep up-to-date and stay ahead of the technological developments, to integrate the technologies to the traditional services and functions. The disruption introduces new ideas and expectations of the PR practitioners, followed by successful communication campaigns, which create more specialized services in this field and subsequently, healthy demands. As a result, the industry profit margin is still high and rising.

Scope of competitive rivalry

The PR industry is highly competitive. Out of the $15.5 billion revenue in 2018, the top 250 firms accounted for $12.3 billion, leaving only a small portion for the hundred thousands of small- and midsized firms.

The larger firms enjoy long-term contracts with high-profile clients, can operate on a bigger level (regional or international) and offer an ample variety of services. With the bigger players still dominate the market, smaller firms opt to be more niche and specialized secure a substantial market share in a specific market segment, instead of positioning themselves under a bigger umbrella or competing on a bigger scale. Small firms can choose to specialize in fewer services, such as only offering digital marketing or lobbying, serve niche client segments, such as luxury brands or health and medical services, or clients in a specific community.

The majority of the firms in the industry are operated with less than four employees, as the owner-operators choose to work with partners and without employees. The industry has attracted more smaller players, resulting in high price competition and low revenue for these micro- and small firm segments.

The determinants of competition in this industry are client service, price, professionalism, creativity and established relationship with the media networks. In addition, PR firms have to demonstrate their digital and social media proficiency to counsel their clients on how to adopt and adapt to this social trend.

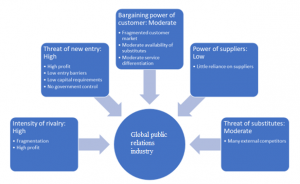

Industry analysis

The PR industry faces high intensity of rivalry, high threat of new entry, moderate bargaining power of customers, moderate to low bargaining power of suppliers and moderate to high threat of substitutes. Nonetheless, the PR industry still has room to grow in all terms of revenue, profit, number of firms and market demand.

The basis of competition among the firms is client service, price, professionalism, creativity and established relationship with the media networks. The competition on relationship has shifted from the representation of mainstream media to social media, as corporate clients and the public now incline to maintain and increase their presence on this platform. Thus, PR firms have to demonstrate their digital and social media proficiency. The smaller firms capitalize on this online communication trend, compete for small business clients and contracts for specialized services and niche markets, while the large firms retain long-term contracts with major corporate clients and offer all-rounded communications solutions.

On the other hand, the industry is also facing increasing competition from substitutes. The external competitors are in-house PR departments, firms or departments of marketing, advertising and management. While the level of competition is growing, the emergence and development of technology and digital media help sustain the demand for specialized services from the PR industry.

There is also a moderate level of service differentiation in the industry. While the larger PR firms have their bargaining power over the buyers with their overall high-standard offer, smaller firms can avoid the buyers dictating the terms by specializing in some niche market or offers. These small firms in the industry that provide services for niche inquiries can typically demand a higher price. Additionally, there are firms specializing exclusively in digital and social practices, alter from the competitors’ offers on traditional PR mediums.

Key success factors

IBISWorld reports (on PR industries worldwide, in Canada and the US) research and identify different key success factors for PR firms in general. According to this world’s independent publisher of industry research, the most important factors for this industry are similar in most countries, and are identified as below:

- Good reputation: As PR firms work to build and maintain the reputation for the clients, they must have a good reputation themselves.

- Good track of performance and capabilities: The firms must be able to effectively plan, communicate and negotiate to protect and enhance the clients’ interests.

- Technology adoption: The ability to adopt and adapt to emerging technologies is critical to the industry. Firms are expected not only to recognize the new technologies but also to be adept at using them. The technologies are changing every day, include but are not limited to digital marketing and advertising tools, social media platforms and artificial intelligence.

- Globalization of the firm: Larger PR firms are expected to perform campaigns at the regional or international level, or to handle global accounts for big clients across markets. Thus, a degree of globalization and a global presence are preferred.

Conclusion

Overall, the industry looks unattractive. The PR firms face rising competition from not only other PR agencies, but also in-house departments, advertising, communications and marketing agencies, all of which have extended their services to include PR. However, the political, economic, social, technology and environmental landscapes are quite favorable for the industry. In particular, the technology factors have boosted the need for social media and digital technology professionals, which create new opportunities and profitability in the immediate future. These environmental factors help mitigate the impact of the current unattractiveness of the industry.

Moving forward, the PR industry will become even more vibrant. The operators will be more knowledgeable and be able to implement more effective campaigns on social media platforms and with digital communication tools. This knowledge and expertise can be obtained internally, with research and training for teams to expand the service, or externally through the acquisition of other digital marketing agencies. As the technology efforts are perceived to be more successful than the traditional PR practice, the industry will experience an ongoing change and a strong, sustainable growth.

By: Dr. Clāra Ly-Le, MPRCA, the Managing Director of @EloQ Communications (formerly Vero IMC Vietnam).

X-posted on EloQ’s Blog.

4 thoughts on “How appealing is the public relations industry?”

Comments are closed.